How the world has achieved middle-class dominance, against the odds

- The global consumer class continues to grow despite turbulence, with over 100 million people expected to join in 2025.

- Three economic scenarios from the seventh edition of the World Consumer Outlook show diverging outcomes depending on policy options and cooperation.

- Spending power remains concentrated and shifting, with future growth increasingly relying on older, wealthier consumers rather than emerging markets alone.

A decade ago, going through customs at El Dorado Airport in Bogotá was a breeze. You could arrive one hour before your flight as hardly anyone was there. Fast forward and now there are long lines, an influx of tourists and families buying their first plane tickets alongside the hustle of a typical international airport. Today, it would do you good to arrive at El Dorado with three hours to spare.

The numbers explain the shift. In 2009, flights in and out of Colombia totalled 24.5 million; by 2024 they had reached a record 56.5 million.

The reason for the increase is simple but slow and therefore easy for the media to overlook. Over the same period, the Colombian consumer class quietly expanded by 13 million individuals, as per the findings of the latest World Consumer Outlook from World Data Lab.

The report details the latest consumer spending projections for 2025 through to 2030.

As people come out of poverty and into the consumer class, their spending changes. They no longer focus only on essentials; they can consider luxuries such as air travel, televisions or even a first car. What is quietly and slowly happening in places such as Colombia is happening globally.

In 2025, World Data Lab projects 106 million individuals will join the "consumer class." World Data Lab has defined the consumer class as people spending over $13 per day (in 2021 Purchasing Power Parity) and is composed of the middle class and the rich.

However, inflation, war and trade have changed our projections, resulting in 10 million fewer entrants to the consumer class.

Despite global challenges, the long-term trend shows progress. The middle and rich classes now total 4.4 billion, outnumbering the 3.6 billion poor and collectively spend over $60 trillion annually.

In 2025, despite the slowest expansion since the pandemic, the global middle class will surpass 4 billion for the first time, becoming the majority. World Data Lab projects this dominance will continue, with another billion people joining the middle class within the next decade, reaching 5.7 billion consumer class individuals out of a world population of 8.7 billion.

It’s worth remembering: trendlines beat headlines. Global growth may be slowing but it hasn’t stalled. This year, World Data Lab found that households will spend $1 trillion less than predicted but they will still add $2 trillion in nominal terms. Accounting for inflation, this represents a real growth of $1.4 trillion (an average of $175 per person per year).

With that said, global economic turbulence is impacting consumer spending, with the World Bank predicting the weakest growth in 17 years. Our analysis explores different scenarios based on geographic spending patterns, revealing a “global prisoner's dilemma,” where states act in their own self-interest, resulting in overall suboptimal outcomes.

'Global prisoner's dilemma'

If the United States, European Union (EU) and China cooperate by easing tariffs and policies, 35 million more people could enter the middle class by 2027. Conversely, if they defect with increased barriers and tightened policies, global growth will suffer, leaving 25 million would-be middle-class entrants stuck, especially in industrial America and export-focused China. Cooperation benefits all, while defection harms all.

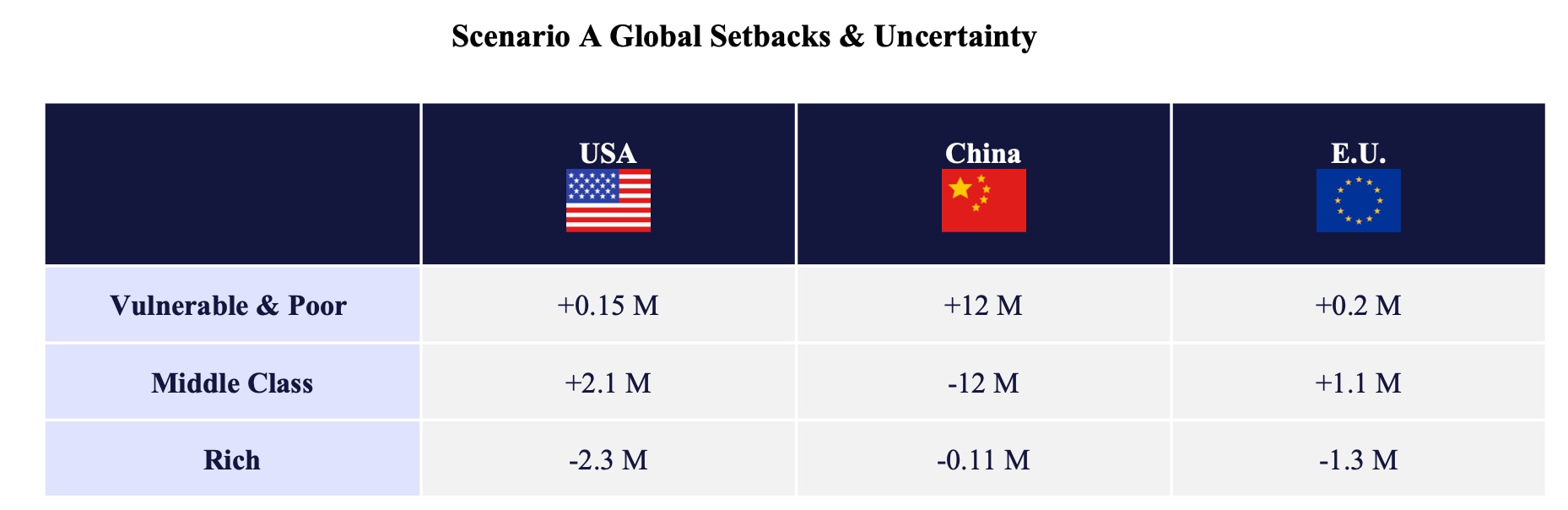

- Scenario (A) setbacks: Global borrowing costs and risk premiums rise; the United States extends its tax cuts; there are no major reforms elsewhere worldwide; and a severe US-China tariff war pushes tariffs sharply higher.

- Baseline (B): The United States and EU cut policy rates; Japan tightens against spending; the United States and emerging markets take on more debt; the EU debt ratio edges up; and trade-policy uncertainty stays high.

- Scenario (C) reforms: Confidence lifts financial conditions; the United States trims debt through reform; the EU boosts public investment; China opens markets and restructures state-owned firms to reduce barriers to entry.

In the downside case, US consumers lose out the most. High interest rates and trade wars cut into purchasing power, especially for the middle class. Even in the upside case, the US middle class doesn’t gain much. Fiscal tightening and higher taxes keep growth in check, especially for those not at the top.

In China, the two scenarios create very different outcomes. In the downside case, Chinese consumers lose ground, especially the middle class, which is hit by shrinking exports and a weaker currency. In the upside case, China’s middle class expands thanks to a stronger currency, more investment and lower interest rates that help smaller businesses.

Europe follows a similar path. In the downside case, Europe suffers from its exposure to global trade, especially with the United States. However, in the upside case, public investment and infrastructure projects drive stronger consumer confidence and economic recovery.

Shifting ground

Slowing growth doesn’t mean the end of global consumer opportunity; the global middle class will still add over 100 million people to its numbers in 2025. But it does mean the playing field is changing.

Spending will be shaped less by booming new markets and more by the challenges of inflation, currency fluctuations, trade policy and the financial stability of older and wealthier consumers.

The United States remains the centre of gravity for global consumption but it is also the most exposed to downside risks. Meanwhile, Europe has the potential to gain ground if it makes smart policy choices. In China, everything depends on whether reforms and stabilization can take hold in time.